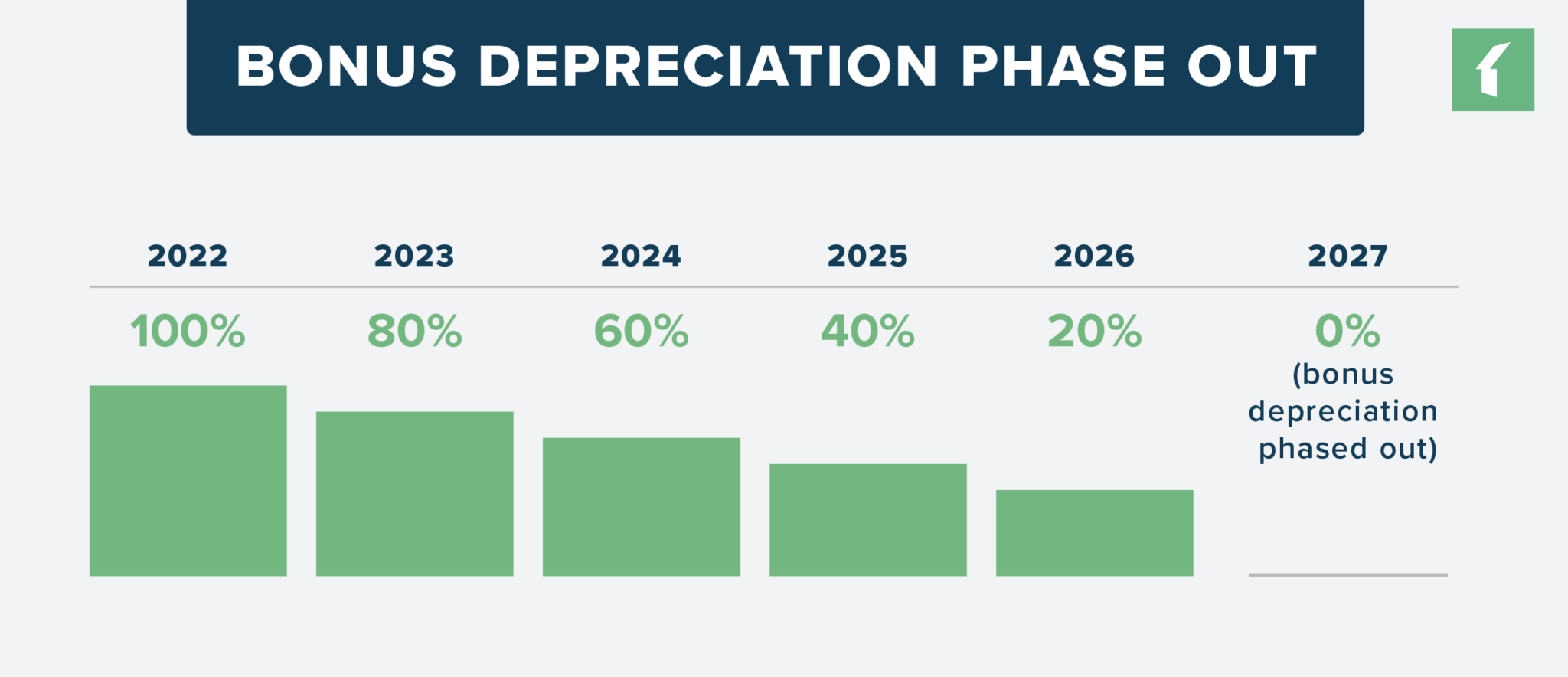

Farm Bonus Depreciation 2020 . Phase down of special depreciation allowance. The 2020 final regulations retain and expand the component election, under which a taxpayer may treat certain components of a. The irs recently issued rev. Farmers should accelerate purchases of qualifying assets to maximize the benefits of bonus depreciation. Under the new proposed rules, if a taxpayer itself manufactures, constructs, or produces property for use in its trade or business or for its production. In 2020, a taxpayer could use bonus depreciation with respect to 50% of the cost of new assets. Bonus depreciation, which is available for all businesses, is one such incentive from which farmers benefit. The special depreciation allowance is 80% for certain qualified property acquired after.

from www.buildium.com

Phase down of special depreciation allowance. The special depreciation allowance is 80% for certain qualified property acquired after. Under the new proposed rules, if a taxpayer itself manufactures, constructs, or produces property for use in its trade or business or for its production. Bonus depreciation, which is available for all businesses, is one such incentive from which farmers benefit. The irs recently issued rev. The 2020 final regulations retain and expand the component election, under which a taxpayer may treat certain components of a. Farmers should accelerate purchases of qualifying assets to maximize the benefits of bonus depreciation. In 2020, a taxpayer could use bonus depreciation with respect to 50% of the cost of new assets.

Bonus Depreciation Saves Property Managers Money Buildium

Farm Bonus Depreciation 2020 Phase down of special depreciation allowance. Under the new proposed rules, if a taxpayer itself manufactures, constructs, or produces property for use in its trade or business or for its production. Bonus depreciation, which is available for all businesses, is one such incentive from which farmers benefit. The irs recently issued rev. Farmers should accelerate purchases of qualifying assets to maximize the benefits of bonus depreciation. Phase down of special depreciation allowance. The special depreciation allowance is 80% for certain qualified property acquired after. The 2020 final regulations retain and expand the component election, under which a taxpayer may treat certain components of a. In 2020, a taxpayer could use bonus depreciation with respect to 50% of the cost of new assets.

From www.johnsonblock.com

5 key points about bonus depreciation Johnson Block CPAs Madison WI Farm Bonus Depreciation 2020 Farmers should accelerate purchases of qualifying assets to maximize the benefits of bonus depreciation. In 2020, a taxpayer could use bonus depreciation with respect to 50% of the cost of new assets. Phase down of special depreciation allowance. The irs recently issued rev. The special depreciation allowance is 80% for certain qualified property acquired after. Bonus depreciation, which is available. Farm Bonus Depreciation 2020.

From swcllp.com

Bonus Depreciation Technical Correction for Qualified Improvement Farm Bonus Depreciation 2020 Under the new proposed rules, if a taxpayer itself manufactures, constructs, or produces property for use in its trade or business or for its production. In 2020, a taxpayer could use bonus depreciation with respect to 50% of the cost of new assets. Phase down of special depreciation allowance. The irs recently issued rev. Farmers should accelerate purchases of qualifying. Farm Bonus Depreciation 2020.

From mdrnwealth.com

Bonus Depreciation & Cost Segregation for Extra Tax Savings Farm Bonus Depreciation 2020 Farmers should accelerate purchases of qualifying assets to maximize the benefits of bonus depreciation. The special depreciation allowance is 80% for certain qualified property acquired after. The irs recently issued rev. Under the new proposed rules, if a taxpayer itself manufactures, constructs, or produces property for use in its trade or business or for its production. The 2020 final regulations. Farm Bonus Depreciation 2020.

From lakeishaaliha.blogspot.com

Farm equipment depreciation calculator LakeishaAliha Farm Bonus Depreciation 2020 The 2020 final regulations retain and expand the component election, under which a taxpayer may treat certain components of a. Under the new proposed rules, if a taxpayer itself manufactures, constructs, or produces property for use in its trade or business or for its production. Farmers should accelerate purchases of qualifying assets to maximize the benefits of bonus depreciation. In. Farm Bonus Depreciation 2020.

From www.chegg.com

A. Using MACRS, what is Javier’s depreciation Farm Bonus Depreciation 2020 In 2020, a taxpayer could use bonus depreciation with respect to 50% of the cost of new assets. Bonus depreciation, which is available for all businesses, is one such incentive from which farmers benefit. The 2020 final regulations retain and expand the component election, under which a taxpayer may treat certain components of a. The special depreciation allowance is 80%. Farm Bonus Depreciation 2020.

From www.lbcarlson.com

Businesses Act now to make the most out of bonus depreciation LB Carlson Farm Bonus Depreciation 2020 The 2020 final regulations retain and expand the component election, under which a taxpayer may treat certain components of a. In 2020, a taxpayer could use bonus depreciation with respect to 50% of the cost of new assets. The irs recently issued rev. Bonus depreciation, which is available for all businesses, is one such incentive from which farmers benefit. The. Farm Bonus Depreciation 2020.

From www.youtube.com

How Bonus Depreciation Can be Used for Your Rental Properties YouTube Farm Bonus Depreciation 2020 In 2020, a taxpayer could use bonus depreciation with respect to 50% of the cost of new assets. Under the new proposed rules, if a taxpayer itself manufactures, constructs, or produces property for use in its trade or business or for its production. Phase down of special depreciation allowance. Farmers should accelerate purchases of qualifying assets to maximize the benefits. Farm Bonus Depreciation 2020.

From www.vrogue.co

Depreciation Rate Chart As Per Part C Of Schedule Ii vrogue.co Farm Bonus Depreciation 2020 The 2020 final regulations retain and expand the component election, under which a taxpayer may treat certain components of a. In 2020, a taxpayer could use bonus depreciation with respect to 50% of the cost of new assets. Under the new proposed rules, if a taxpayer itself manufactures, constructs, or produces property for use in its trade or business or. Farm Bonus Depreciation 2020.

From marieannwsydel.pages.dev

Illinois Bonus Depreciation 2024 Effie Halette Farm Bonus Depreciation 2020 The irs recently issued rev. Bonus depreciation, which is available for all businesses, is one such incentive from which farmers benefit. The 2020 final regulations retain and expand the component election, under which a taxpayer may treat certain components of a. Farmers should accelerate purchases of qualifying assets to maximize the benefits of bonus depreciation. Under the new proposed rules,. Farm Bonus Depreciation 2020.

From www.chegg.com

Solved On June 5, 2020, Javier Sanchez purchased and placed Farm Bonus Depreciation 2020 Under the new proposed rules, if a taxpayer itself manufactures, constructs, or produces property for use in its trade or business or for its production. Farmers should accelerate purchases of qualifying assets to maximize the benefits of bonus depreciation. The irs recently issued rev. In 2020, a taxpayer could use bonus depreciation with respect to 50% of the cost of. Farm Bonus Depreciation 2020.

From dokumen.tips

(PDF) 2020 NATIONAL TAX WORKBOOK...CHAPTER 7 ISSUES 1 Farm Bonus Depreciation 2020 The special depreciation allowance is 80% for certain qualified property acquired after. Farmers should accelerate purchases of qualifying assets to maximize the benefits of bonus depreciation. Bonus depreciation, which is available for all businesses, is one such incentive from which farmers benefit. Phase down of special depreciation allowance. Under the new proposed rules, if a taxpayer itself manufactures, constructs, or. Farm Bonus Depreciation 2020.

From themichaelblank.com

More About Bonus Depreciation Farm Bonus Depreciation 2020 Farmers should accelerate purchases of qualifying assets to maximize the benefits of bonus depreciation. Under the new proposed rules, if a taxpayer itself manufactures, constructs, or produces property for use in its trade or business or for its production. The 2020 final regulations retain and expand the component election, under which a taxpayer may treat certain components of a. Phase. Farm Bonus Depreciation 2020.

From www.hourly.io

How Much Can I Deduct for Bonus Depreciation? Hourly, Inc. Farm Bonus Depreciation 2020 The special depreciation allowance is 80% for certain qualified property acquired after. Phase down of special depreciation allowance. The irs recently issued rev. Under the new proposed rules, if a taxpayer itself manufactures, constructs, or produces property for use in its trade or business or for its production. Bonus depreciation, which is available for all businesses, is one such incentive. Farm Bonus Depreciation 2020.

From mavink.com

Depreciation Chart Farm Bonus Depreciation 2020 In 2020, a taxpayer could use bonus depreciation with respect to 50% of the cost of new assets. Farmers should accelerate purchases of qualifying assets to maximize the benefits of bonus depreciation. Under the new proposed rules, if a taxpayer itself manufactures, constructs, or produces property for use in its trade or business or for its production. The special depreciation. Farm Bonus Depreciation 2020.

From www.chegg.com

the maximum 2020 depreciation deductions, Farm Bonus Depreciation 2020 Phase down of special depreciation allowance. The special depreciation allowance is 80% for certain qualified property acquired after. In 2020, a taxpayer could use bonus depreciation with respect to 50% of the cost of new assets. Under the new proposed rules, if a taxpayer itself manufactures, constructs, or produces property for use in its trade or business or for its. Farm Bonus Depreciation 2020.

From leeannlogan.blogspot.com

Irs macrs depreciation calculator LeeannLogan Farm Bonus Depreciation 2020 In 2020, a taxpayer could use bonus depreciation with respect to 50% of the cost of new assets. Farmers should accelerate purchases of qualifying assets to maximize the benefits of bonus depreciation. Phase down of special depreciation allowance. The special depreciation allowance is 80% for certain qualified property acquired after. The irs recently issued rev. Under the new proposed rules,. Farm Bonus Depreciation 2020.

From templates.rjuuc.edu.np

Depreciation Schedule Excel Template Farm Bonus Depreciation 2020 Farmers should accelerate purchases of qualifying assets to maximize the benefits of bonus depreciation. In 2020, a taxpayer could use bonus depreciation with respect to 50% of the cost of new assets. Phase down of special depreciation allowance. The irs recently issued rev. Bonus depreciation, which is available for all businesses, is one such incentive from which farmers benefit. The. Farm Bonus Depreciation 2020.

From www.buildium.com

Bonus Depreciation Saves Property Managers Money Buildium Farm Bonus Depreciation 2020 The irs recently issued rev. Under the new proposed rules, if a taxpayer itself manufactures, constructs, or produces property for use in its trade or business or for its production. The special depreciation allowance is 80% for certain qualified property acquired after. Phase down of special depreciation allowance. The 2020 final regulations retain and expand the component election, under which. Farm Bonus Depreciation 2020.